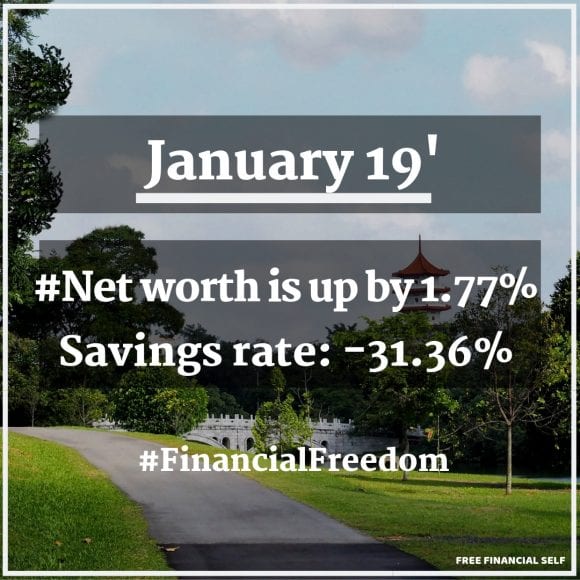

This is my monthly report of our personal net worth progress for January 2019

I’m sharing this to show how important it is to track your net worth and seeing the progress. This is what I also expect and advise my clients.

From tracking this, you can learn what works and what you should change in your finances. If you’d like to also track your personal net worth the way I do, I created a version of it, especially for my readers. You can get it here.

Also, if you’d like to read the previous report to get the flow of things, you can check it here – December 2018 personal net worth report. The page with all previous reports is here.

If you don’t know what the net worth definition is, check it here.

Table of Contents

OVERVIEW

Now on with the show!

Our net worth is up by another 1.77% this month, despite our large expenses. We bought our flight to our Sri Lanka workation. (see below). The flight though will be paid back monthly by renting our yurt on Airbnb. So, the bottom line is the savings rate this month is negative: -31.36%

A bit of Envestio news. So, Envestio released more project this month but with lower interest rates. They are saying that now that they have enough investors in their system, they can afford to have more business in, as before they couldn’t afford the high-interest rates to pay. Envestio is really open about their plans and platform, and they have no problem if clients come to visit at the office and ask difficult questions. Jorgen did it once and just recently Jons Slemmer had another visit, asking some difficult question. So, read that review too.

Anyway, If you do decide to join Envestio through my link, I’ll get some bonus from them to invest more in my portfolio and you’ll get an extra 5 € bonus + 0.5% cash back for the next 270 days after you invest.

I’m also looking at buying a UK property very soon. It takes longer than I thought, unfortunately. The thing is I’m looking for a tenanted house, which can generate cash flow from day 1. But so far, the two houses I was looking into were not tenanted.

The first was by a mistake in a tenanted properties list I got a while ago. For the 2nd, I actually started the due diligence process with a legal firm and they came up with things I should pay attention to. But this morning, an email came from the legal advisor saying that the tenant is about to leave. So, I’m now checking to see what the next step is, and consult my legal advisor.

We reached a nice milestone this month too (Drums please!). We broke even on the building of our yurt after a bit more than 2.5 years. This means that now every day that we stay in our place (and for now we don’t have a reason to move), it’s pure profit! That’s almost 40% yearly return on investment!

This month’s tracking improvements:

- I have a US portfolio with First Trade. I realized that I don’t track the interest I’m getting on the cash in my account. So, this month it’s in. Tiny amounts, but in!

- Do any of you have any net calculations with the family of friends? I do. I didn’t track those either. But this month I realized they should be in the net worth calculation, as an asset or debt. So, I added that in too for the first time.

Let’s dive into the details of our personal net worth.

OUR PERSONAL NET WORTH ANALYSIS

Loans: Nothing new on this front. My loans rates are probably the lowest I can get in the market. I sent another message to liquid expats to see if they are able to fund 2-4 houses worth 100 GBP instead of a single house worth the same amount which is their minimum offer.

US & Israeli Stock portfolio: Portfolio is back to going up. Almost up to the same point two months ago. But not as high as 6 months ago. I’ll be lying, of course, if I’d say I’m not happy that the portfolio is going up. But just like when the markets are going down and I’m saying it doesn’t matter as I’m in for the long term, same as it goes up. These are all tiny fluctuations. The measure should be on the least 5-7 years if not more (I’m in for 30+ years) and on that front, I’m doing great.

US Real Estate: The money from the selling part of those houses portfolio is finally at the bank. It costs more than 70 USD just to deposit that check with all the processing involved. Outrageous! But there was nothing I could do about it. Any ideas for the next time? Anyway, that amount as I said didn’t change my personal net worth I kept with this investment. It also doesn’t count as an income. As this is a return on investment. So, until the selling amount does not exceed the principal invested, it will keep to be counted this way. It did of course help with the cash flow. This money is going towards the UK real estate investment I’m working on.

Bitcoin: Bitcoin’s value went a bit more down this month. My Hashflare Mining is not profitable anymore by the way. I wonder if they will ever resume. They are selling now other crypto contracts on their website, but not Bitcoin.

PERSONAL AND PROFESSIONAL LIFE:

Travel: It finally happened! (See why I’m so excited on the previous month report). More than a month late from the original date, we flew to Sri Lanka. We are here for a 3 months workation until mid-April. Here a bit of what we had so far:

So far, we’ve spent time with another local homeschooling family. She is a local famous artist. Our girl had a great time with her 2 girls for a few days. We also spent time on an Airbnb with a local family. It wasn’t a hotel but their house. We came as guests left as friends.

Interviews: Yesterday I had a live interview with Anastasia Button. She helps Millennials in creating their future desired lifestyle. So, I was glad to give her audience some about the personal finances aspect of things. Invite you to watch it.

I also had a cool interview on the China Tech investor Podcast.

It was an interesting one, as the listeners are mainly focused on tech stocks in China. So, for me it was not about recommending any specific stock. It was about my investments philosophy and how it should be aligned with your lifestyle.

It’s published on Technode.com, so you can check it out here.

Or listen directly:

Reading: I’m behind on my reading must say. Last month I said I’m reading Sri Lanka: The New Country by Padma Rao Sundaraji on Kindle. It’s super interesting especially that we are now in Sri Lanka. Just makes me want to visit all the places the author mentions. I learned a lot from it. Anyway, I’m still reading that but about to finish.

I also started another book related to Sri Lanka. Stories from The History Of Ceylon for children. It’s supposed to be for children, but really we enjoy it. We learn through it about the history and myths of the country. It’s for adult too, though the title.

Anyway, I invite you to follow my Goodreads profile and read along with me. I’d love to share ideas.

Shlomo’s bookshelf: read

Lifestyle: So there are a few things I wanted to do once we get to Sri Lanka. I need to prioritize them though. I don’t have enough time for all. My list consists of, Kite surfing classes, learn Sinhala and Yoga classes.

Yoga is last as it’s also possible to do in Israel, Kitesurfing is also possible to learn in Israel but way more expensive. While Sinhala as first as I can learn it properly and most cost-effective only here in the world.

So, I hope to speak today with a Sinhala teacher and have some schedules classes. As for kite surfing, we are not in the right area for that now, so that will have to wait.

NOW OVER TO YOU

Do you track your personal net worth? What insights did you get this month? Add it in the comments.

Comments

I’m interested to know more about Envestio.

Is that a kind of electronic stock or currency?

Qian, Envestio is a crowd investing platform. You can invest your money into a few projects at the same time with a small amount. This is how you get access to invest in a project that gives a nice return (15%+ a year) and can diversify your investment between a few projects. I hope this answers your question.

Love the books on your Goodreads shelf. I just read The Dumb Things Smart People Do With Their Money by Jill Schlesinger. It’s a fun read, but it’s very US-focused so I don’t know how much it would translate globally. I also read an advance copy of Professor Chandra Follows His Bliss by Rajeev Balasubramanyam, which I think would appeal to the searchers and travelers that probably read this blog.

As for net worth, thanks for the details! We have a lot of real estate in our profile too and are considering selling one place that we feel has reached its peak appreciation to trim the portfolio and free up some cash. Always decisions to be made!

Thanks for the comment Caroline. Do you have Goodreads profile? I’d love to follow.

Are you going to buy another property with that cash you’re releasing or trying to go out of real estate all together?